Auto Loan Crisis Gets Worse

Index

Index

The auto loan crisis in the United States has reached a new level of severity, with default rates increasing and borrowers struggling to meet their monthly payments.

This worrying trend is causing concerns among experts who fear a potential collapse in the auto loan market, similar to what was witnessed during the subprime mortgage crisis more than a decade ago.

Recent reports indicate that delinquencies for auto loans have been steadily rising over the past few years. According to the Federal Reserve Bank of New York, as of 2021, the number of seriously delinquent auto loans (90 or more days overdue) stood at over $60 billion. This represents an alarming increase of approximately 21% from pre-pandemic levels.

One contributing factor to this crisis is the precarious financial situation many Americans find themselves in due to the economic fallout from the COVID-19 pandemic. The pandemic has caused widespread job losses, reduced income for millions, and increased financial instability. As a result, households are struggling to keep up with their monthly expenses, including auto loan payments.

Another concerning aspect is the rise in subprime lending within the auto loan market.

Similar to what occurred during the housing bubble leading up to the 2008 financial crisis, lenders have been approving loans for individuals with poor credit histories and questionable repayment capacity. These high-risk borrowers are more likely to default on their loans, which adds fuel to an already volatile situation.

Additionally, extended loan terms have become commonplace within the auto industry. More consumers are opting for longer loan durations—typically up to 84 months—to make their monthly payments more manageable. However, this can lead borrowers into negative equity situations where they owe more on their cars than they are worth. In turn, this makes it harder for them to refinance or sell their vehicles if needed.

The consequence of these factors is a vicious cycle where defaults and repossessions increase and lenders tighten their lending practices, making it more difficult for future borrowers to secure loans. Moreover, the impact of a collapse in the auto loan market could extend beyond just lenders and borrowers – it would significantly affect the automotive industry as a whole. A sharp decline in car sales and repossessions could lead to job losses and financial instability throughout the sector.

To address this growing crisis, policymakers, regulators, and creditors need to take urgent action.

Lenders should reassess their lending practices and exercise stricter due diligence when approving loans, avoiding predatory lending behaviors that target vulnerable individuals. Government agencies can also play a role by closely monitoring the market, implementing regulations to ensure responsible lending practices are followed.

Furthermore, consumer education and financial literacy programs should be strengthened to assist borrowers in making informed decisions about their auto loans and managing their personal finances effectively. Empowering individuals with knowledge about budgeting, interest rates, repayment strategies, and loan terms can help prevent them from falling into unsustainable debt situations.

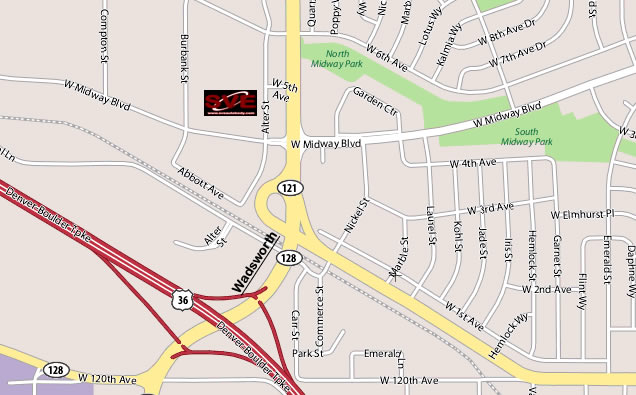

(303) 466-6717

465 Alter Street, Broomfield, CO 80020

Conclusion

While the auto loan crisis has certainly worsened in recent years, it is not yet too late to mitigate its impact. Swift action from all stakeholders involved is crucial to prevent further damage to individual borrowers, lenders, and the overall economy. By addressing irresponsible lending practices and improving financial literacy resources for consumers, we can work towards stabilizing the auto loan market before it escalates into a full-blown crisis reminiscent of the subprime mortgage nightmare.